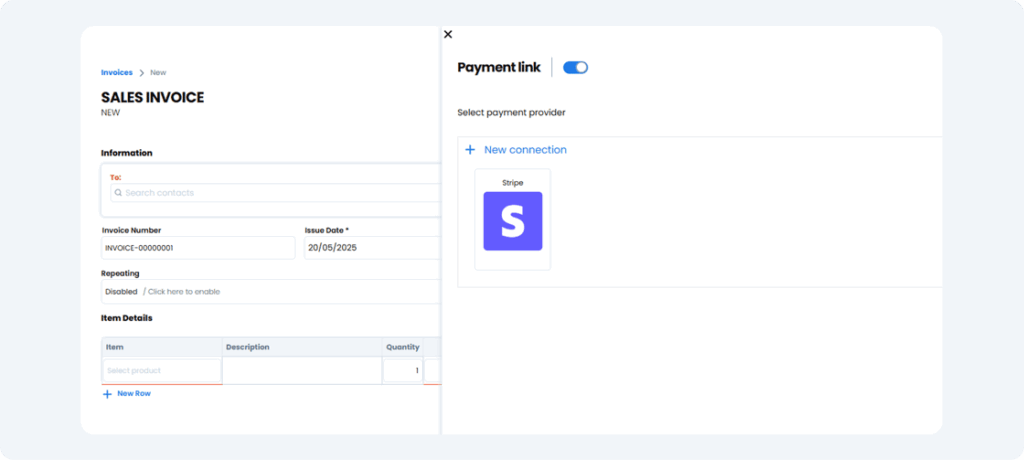

Stripe Integration

Afirmo now integrates with your Stripe account to help you get paid faster and save time on reconciliation.

- Stripe Invoice Payment Links — Create Stripe payment links for Afirmo invoices so customers can pay you instantly. When enabled, the Stripe payment link is automatically added to your invoice. Try creating a new invoice here.

- Stripe Transactions in the Afirmo App — Transactions from Stripe automatically appear in Afirmo, keeping your records clean, accurate, and up to date — no manual coding needed. Connect your Stripe account here.

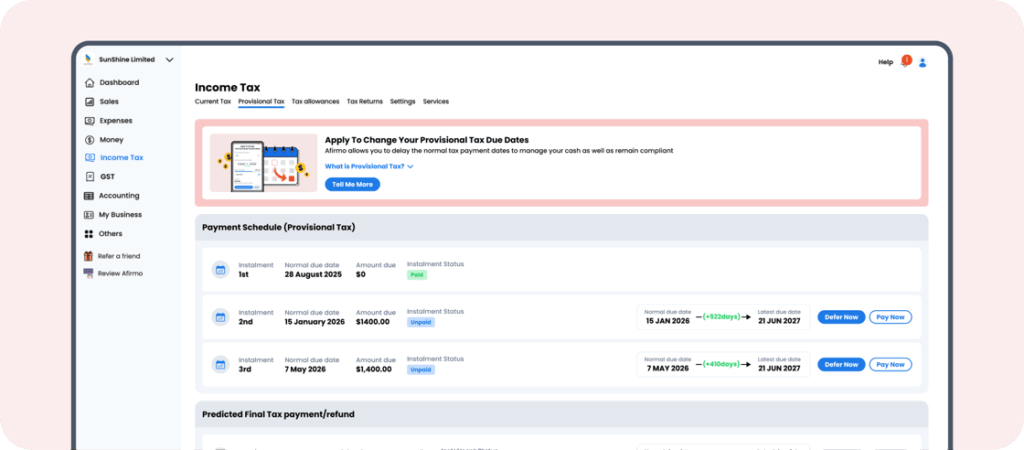

In-App Provisional Tax Deferment

Delay your tax. Keep your cash. Stay compliant.

You can now defer your Provisional Tax payments by up to 1.5 years — fully approved by Inland Revenue and managed for you by Afirmo.

- Defer up to 18 months

- 100% acceptance guaranteed

- We handle the process with IRD

- Maintain a clean compliance history

- Improve your cash flow when it matters most

- Full suite of Provisional Tax FAQs

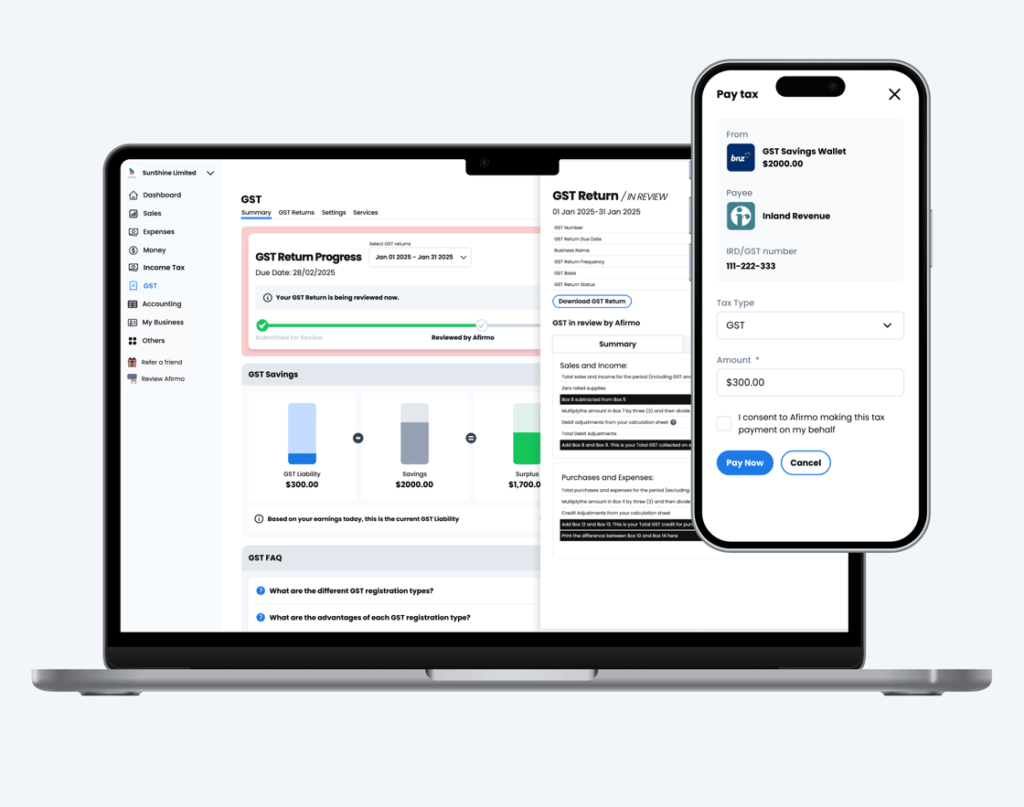

Updated GST Dashboard

We’ve updated our GST dashboard to give you total visibility — plus the flexibility to manage your returns your way.

- Live GST calculations updated 24/7

- View and edit your GST position anytime

- Returns are IRD-compliant and ready to file

- Afirmo tax experts review every return before it’s submitted

- Change your return frequency or accounting basis in-app

- Full suite of GST FAQs

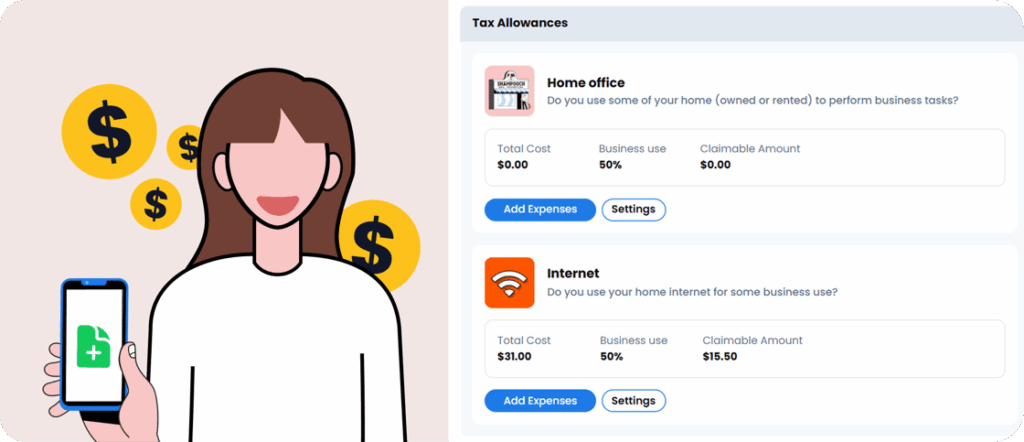

Income Tax Allowances

Claim business-use personal expenses with ease. Set up Income Tax Allowances to claim deductions for personal expenses like your home office, car, internet or phone — all handled inside Afirmo. This helps minimise your Income Tax bill, ensures IRD compliance, and keeps your deductions organised year-round.

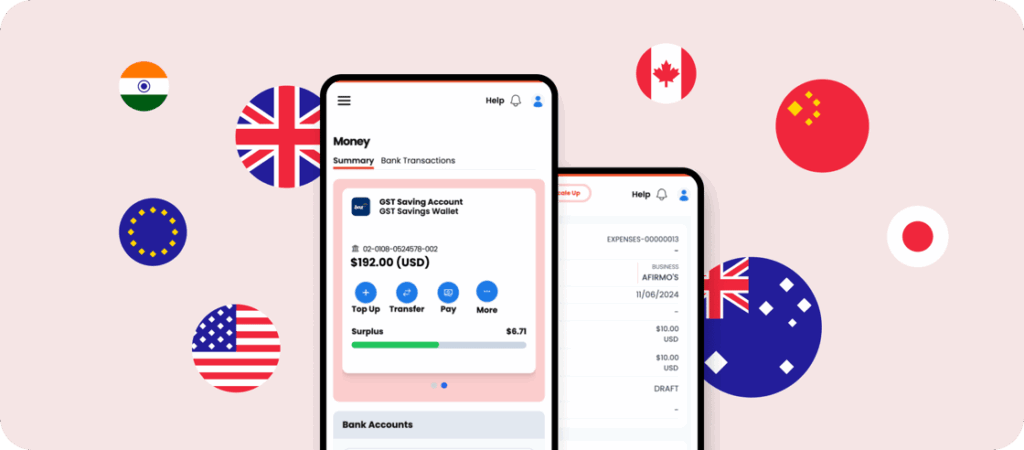

Multi-Currency Invoicing

Send invoices in multiple currencies — and track conversions with ease. Invoice international clients in their currency and automatically track exchange rate differences. Afirmo records gains or losses and helps you get paid faster, without manual adjustments.

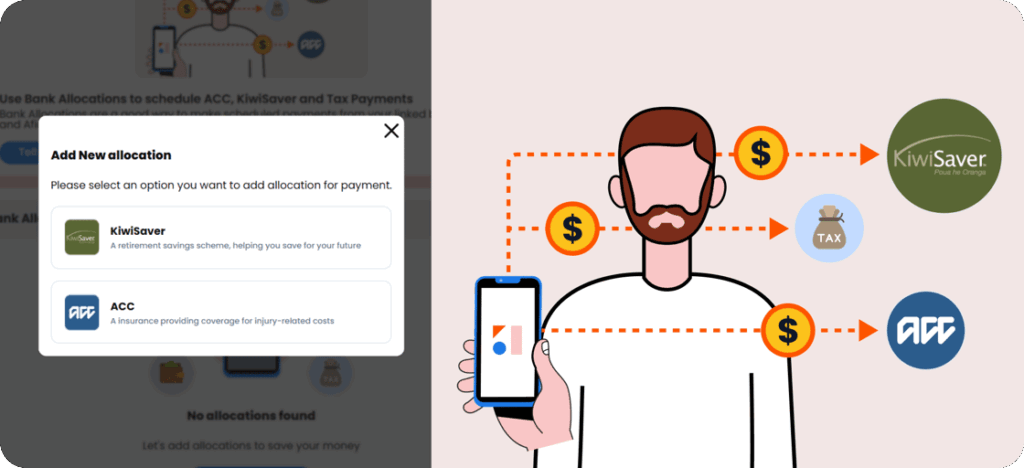

Bank Allocations

From the app, you can use Bank Allocations to schedule and prepare for upcoming payments like ACC, KiwiSaver, and Tax Payments from your linked bank accounts and wallets. Make scheduled payments to IRD and other agencies so you can keep on top of your commitments – and spend more time on your business.