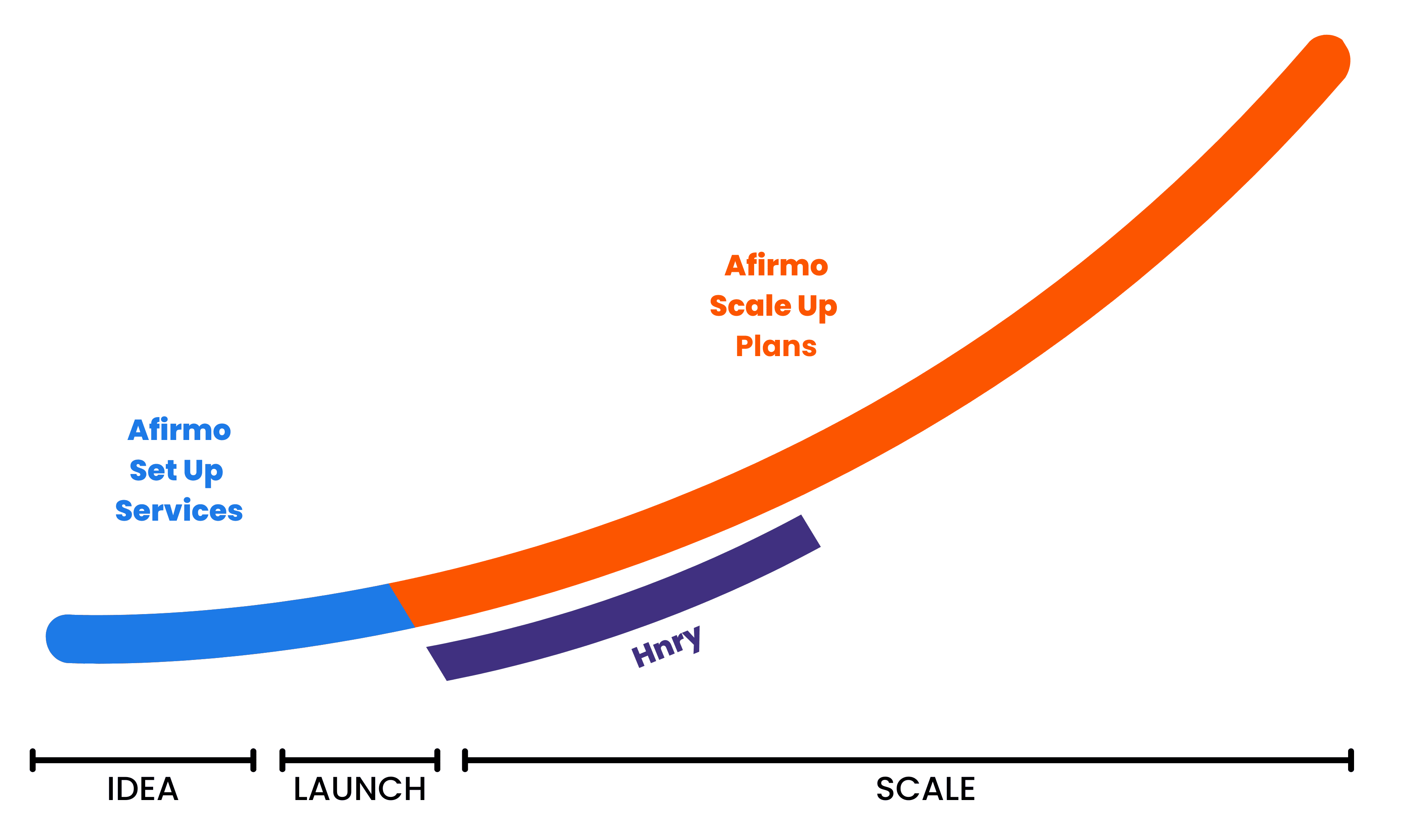

Set Up & Scale Up – Afirmo is with you all the way!

It’s easy to see Afirmo offers you a lot more than Hnry! Afirmo is here to support you with a cross section of business management services, while Hnry is only a payment and tax management support tool.

Afirmo offers you more and has you covered

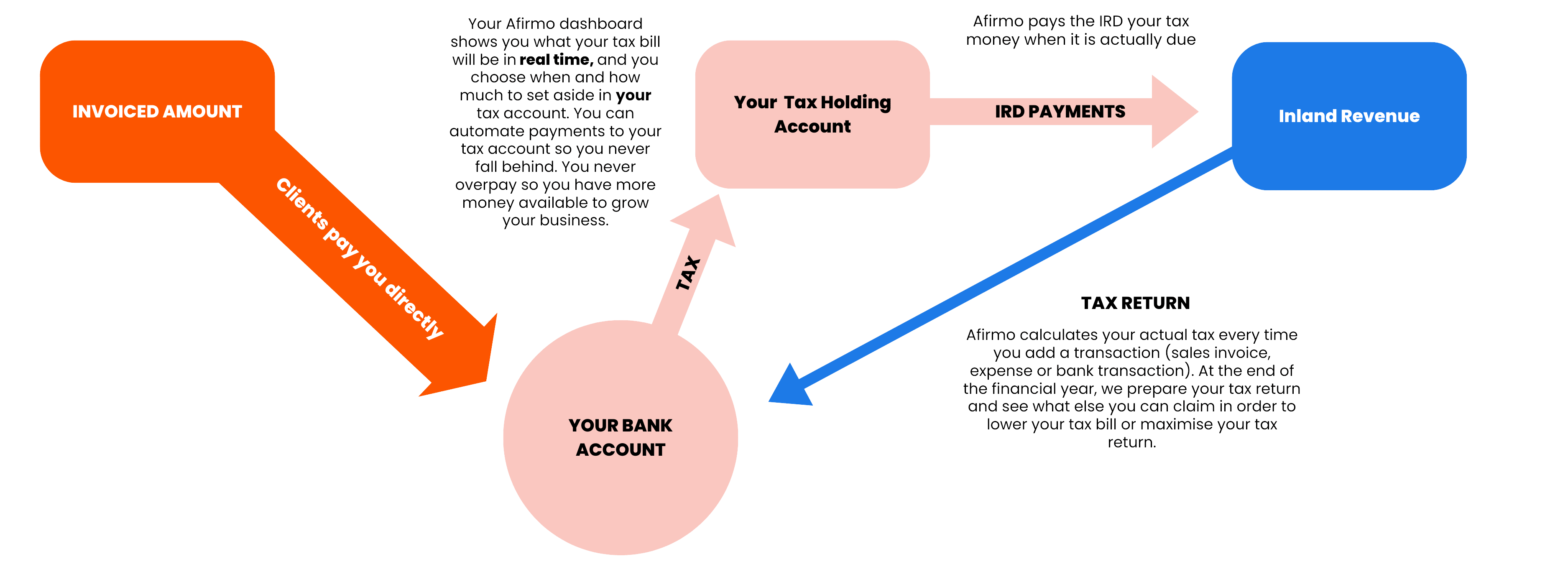

Unlike Afirmo, Hnry only acts as a payments provider, simplifying self-employment so users get paid as if they are an employee in a company, with payslips and all! If you have been in business a while, it is likely you are looking for more control of your tax management and cashflow and Afirmo has got you covered

Afirmo Suits all Shapes and Sizes

Is Afirmo right for you?

That depends on you and your business and your future. If you are starting a business it’s tempting to opt for a sole trader set up. Before you opt for sole trader status, take time to think carefully about your long-term plans for your business. If you think your business will grow, and you will need staff, or if you have plans to one day sell your business, consider opting for a partnership or company business formation set up, to ensure your business in future proofed.

Afirmo offers services to sole traders, partnerships and companies. Hnry only caters for sole trader businesses. So, if you have plans to have a business that grows and thrives and that you want to sell one day, Afirmo is here for you

Afirmo vs Hnry

| Features | Afirmo | Hnry |

|---|---|---|

| Business Set Up tools (getting started, basics and marketing) | ✅ | ❌ |

| Bank account issued* | ✅ (BNZ Wallets) | ✅(ASB) |

| Categorise and match transactions in your linked bank account(s) |

✅ | ❌ |

| Sales invoices and sales quotes | ✅ | ✅ |

| Expense claims | ✅ | ✅ |

| Accounts preparation | ✅ | ❌ |

| Tax agent support | ✅ | ✅ |

| Pay more fees as you grow | 🙅🏽 No way! | Yes, a lot too! |

*Afirmo issued bank accounts are in the form of BNZ Wallets. Unlike Hnry you can control the funds within. You can set up as many wallets as you like and withdraw funds at any time. When you are issued a Hnry ASB Account it is controlled by them. You cannot see how much money you have stored there or withdraw funds from the account. Details based on non-promotion-based details as of November 2023

Afirmo has tailored options to suit you and your business, dependent on how much support you need with your tax, while Hnry charges a flat 1% of your income – essentially they offer one-size-fits-all.

Afirmo software has been designed to meet the needs of complex and simple businesses alike

This is an important factor if you’re growing fast. Afirmo knows all businesses have differing needs, so we use different tricks (by the book of course) for claiming appreciation and depreciation, to create a tailored solution that is right for you and your business. This means you get the best possible tax outcome and position to continue growing your business. With Hnry, their pricing includes tax management, but they do not work with you to minimise the amount of tax you’ll have to pay or maximise your tax return.

Afirmo vs Hnry – Financial Management and Tax

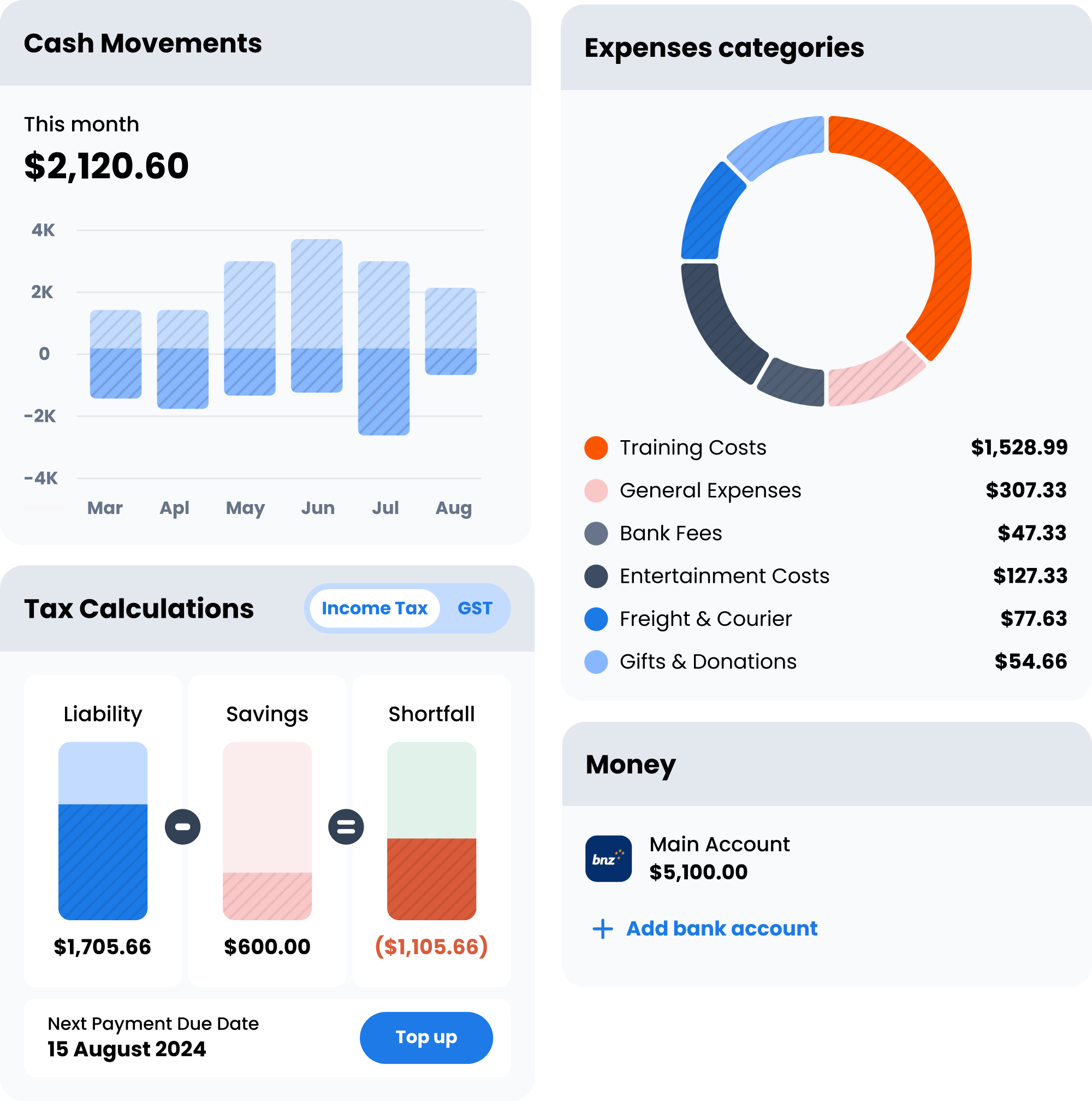

Afirmo ensures you have financial control – liquidity and control in any business is critical.

🚀 Hnry takes away your financial control over your business

🚀 Afirmo does not charge you more, unlike Hnry, when you start to earn more – we do not penalise your success

🚀 Afirmo knows you are the boss, so, unlike Hnry, Afirmo does not not issue you with payslips

🚀 Afirmo manages your tax returns for you, like Hnry, except Afirmo offers full transparency and visibility

🚀 With Afirmo, unlike Hnry, you reap the benefits of not having to pay tax earlier than you need to – with Afirmo that money can work for you while you wait for tax time. Cash is king

🚀 With Afirmo, unlike Hnry, when you need money urgently for your business, you can access the money that has been set aside for GST

How Afirmo Manages Your Tax

How Hnry Manages Your Tax

Different Fee Structures

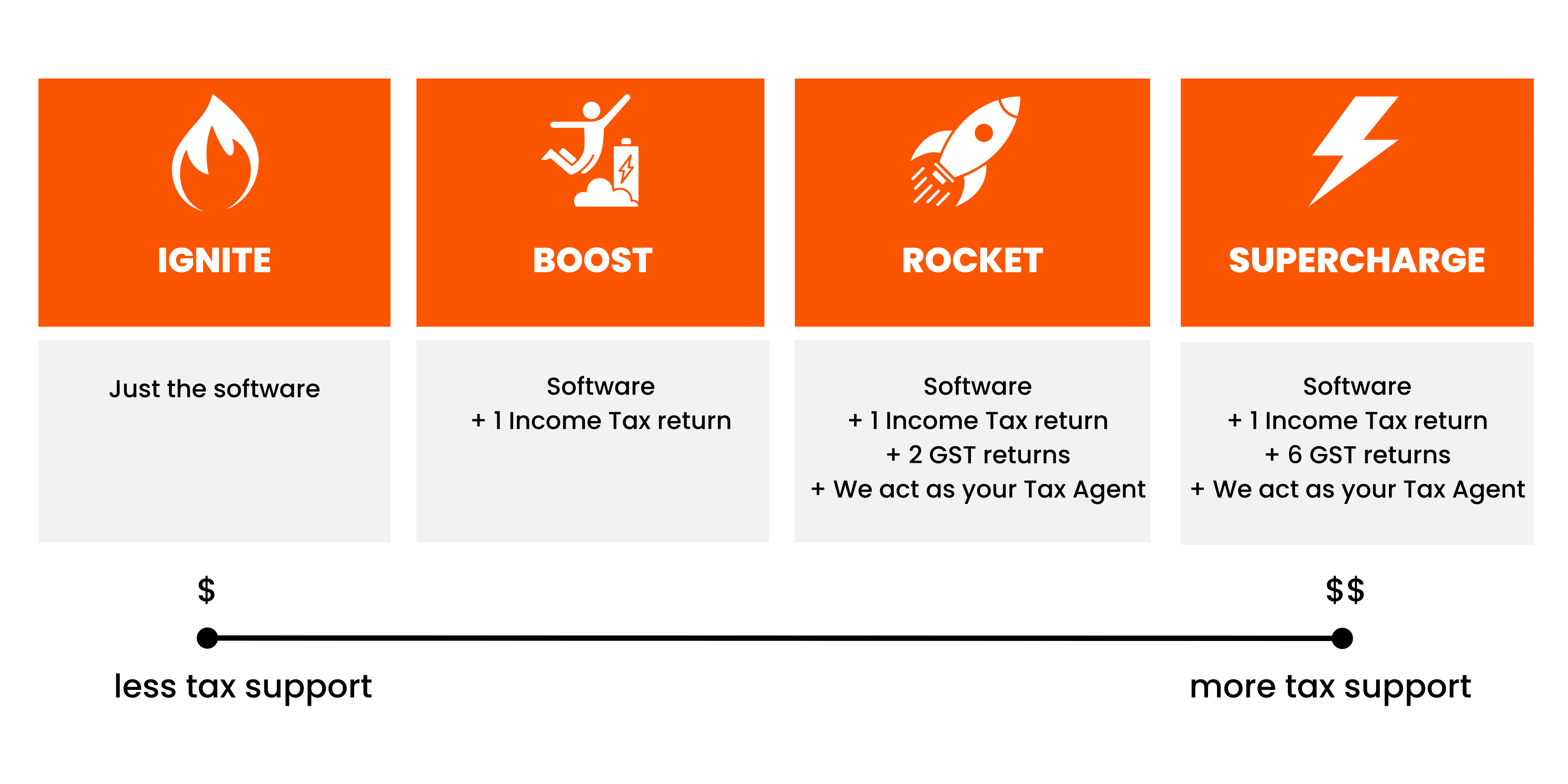

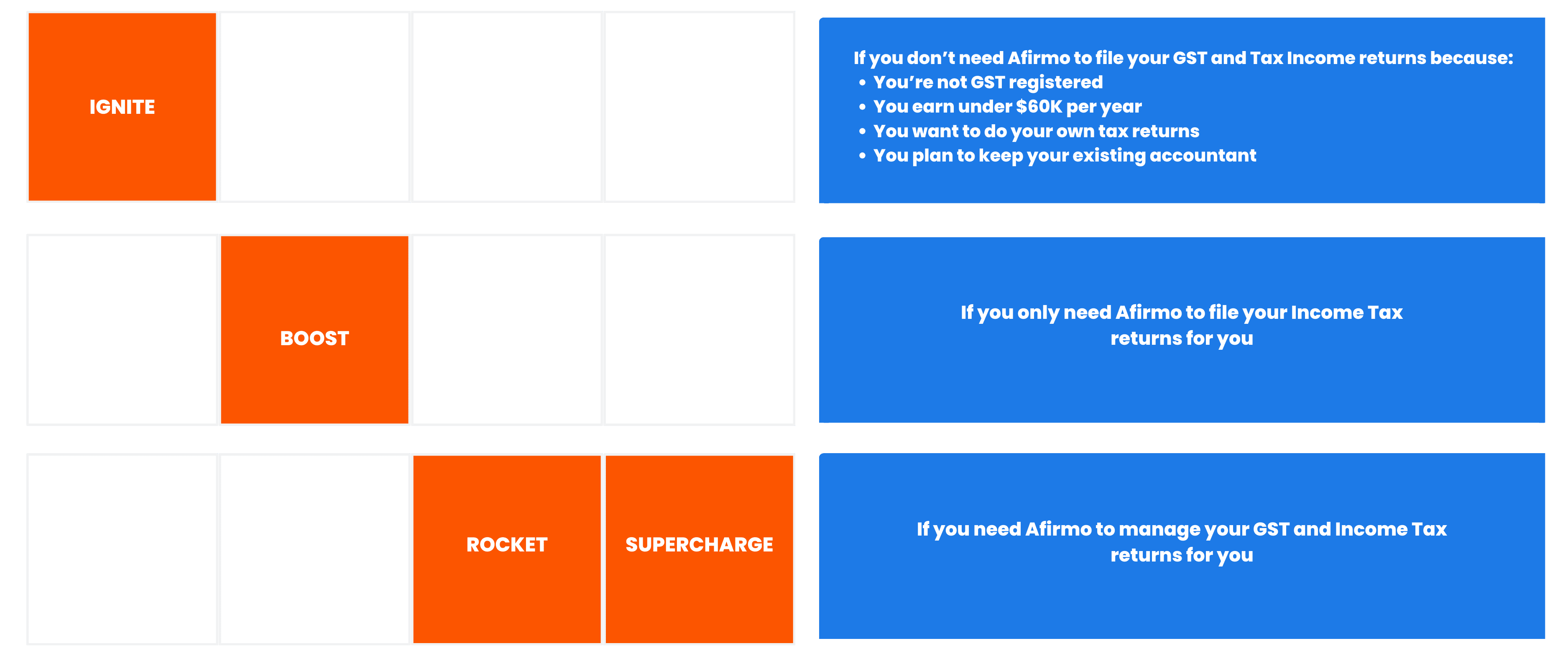

First let’s take a look at the Afirmo Scale Up plans and what they include:

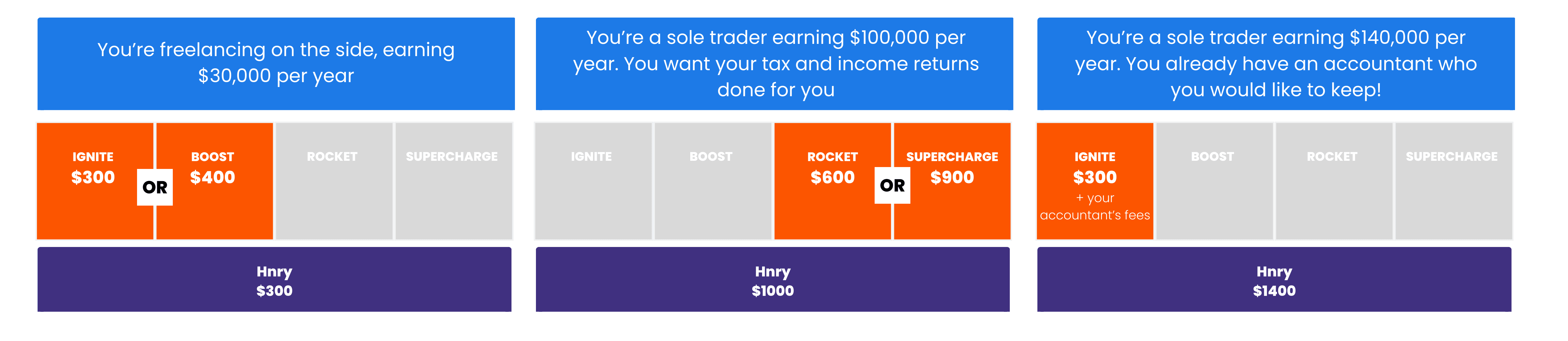

Depending on how much you earn, Hnry’s fees will change. Hnry takes 1% of your income, up to $1500 per year. With Afirmo it isn’t about how much you make, but rather how much support you need. If you’re comfortable filing your own tax returns or you have an accountant you’re using then you pay less.

Flexible Solutions for Your Business with Afirmo

If you want Afirmo to file your Income Tax and GST returns (up to six of them!) we can do this too. It all comes down to the subscription plan you choose.

When we complete and file your Income Tax returns we’ll talk with you about the different methods available so you are positioned to potentially pay less tax.

Comparing Annual Costs

Check out a few scenarios to see how Afirmo fees stack up against Hnry’s

*Details based on non-promotion-based details as of November 2023