Easily manage your money, and make tax management stress-free.

Simpler than other accounting software platforms and with enough levers to keep you in charge. Afirmo’s Scale Up service is your all-in-one cloud solution letting you easily manage your money.

Our monthly plans include an accountant who files your tax returns for you, with no add-ons or hidden fees*

*Tax and income returns and tax agency available on certain plans.

Plan Price

Plan Price

![]() Afirmo will review your business GST returns for you before we file it with the IRD on your behalf as your registered tax agentBusiness GST Returns

Afirmo will review your business GST returns for you before we file it with the IRD on your behalf as your registered tax agentBusiness GST Returns

![]() Afirmo will review your business Income Tax return for you before we file it with the IRD on your behalf as your registered tax agentIncome Tax Return

Afirmo will review your business Income Tax return for you before we file it with the IRD on your behalf as your registered tax agentIncome Tax Return

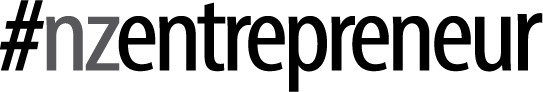

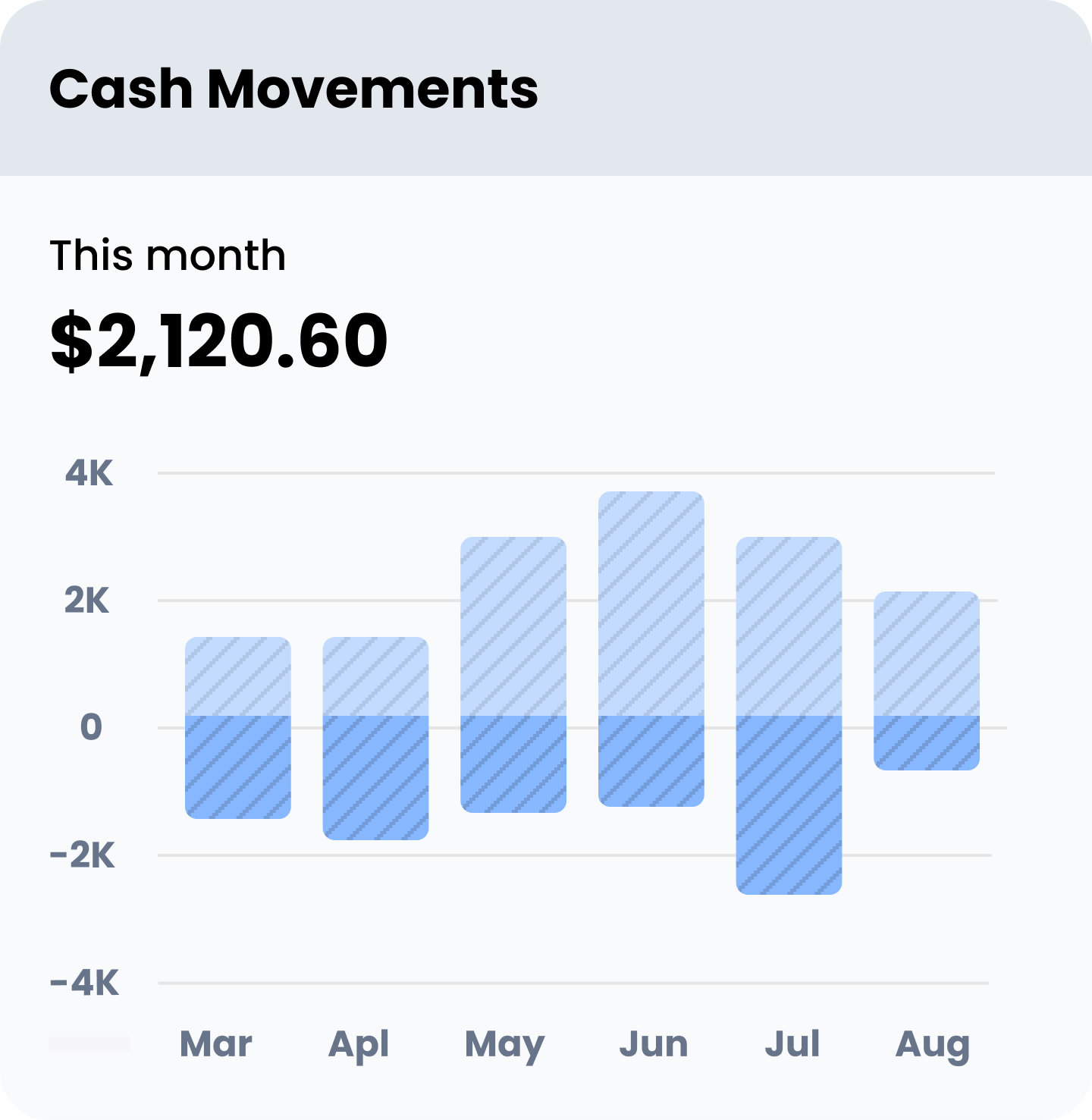

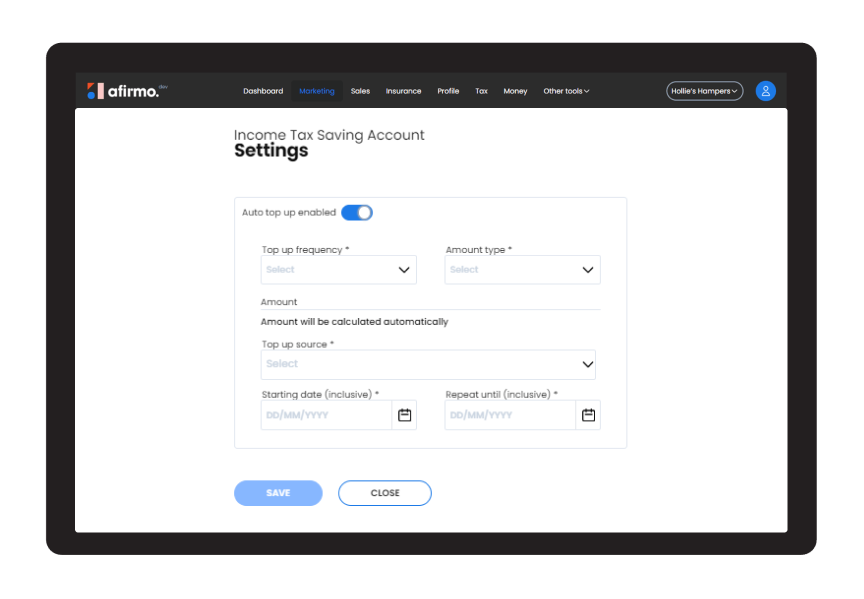

![]() You can save money in the Afirmo app towards your tax bills. You can authorise us to make the payments to the IRD when they are dueTaxes Paid Automatically

You can save money in the Afirmo app towards your tax bills. You can authorise us to make the payments to the IRD when they are dueTaxes Paid Automatically

![]() Afirmo will represent you with the IRD for routine tax queries relating to submitted tax returnsIRD Representation

Afirmo will represent you with the IRD for routine tax queries relating to submitted tax returnsIRD Representation

![]() Companies need to prepare accounts. Afirmo will prepare these for you under the Supercharge planYear End Accounts

Companies need to prepare accounts. Afirmo will prepare these for you under the Supercharge planYear End Accounts

Plan Price

$25 + GST

Plan Price

$250 pa

![]() Afirmo will review your business GST returns for you before we file it with the IRD on your behalf as your registered tax agentBusiness GST ReturnsExcluded

Afirmo will review your business GST returns for you before we file it with the IRD on your behalf as your registered tax agentBusiness GST ReturnsExcluded

![]() Afirmo will review your business Income Tax return for you before we file it with the IRD on your behalf as your registered tax agentIncome Tax ReturnExcluded

Afirmo will review your business Income Tax return for you before we file it with the IRD on your behalf as your registered tax agentIncome Tax ReturnExcluded

![]() You can save money in the Afirmo app towards your tax bills. You can authorise us to make the payments to the IRD when they are dueTaxes Paid AutomaticallyExcluded

You can save money in the Afirmo app towards your tax bills. You can authorise us to make the payments to the IRD when they are dueTaxes Paid AutomaticallyExcluded

![]() Afirmo will represent you with the IRD for routine tax queries relating to submitted tax returnsIRD RepresentationExcluded

Afirmo will represent you with the IRD for routine tax queries relating to submitted tax returnsIRD RepresentationExcluded

![]() Companies need to prepare accounts. Afirmo will prepare these for you under the Supercharge planYear End AccountsExcluded

Companies need to prepare accounts. Afirmo will prepare these for you under the Supercharge planYear End AccountsExcluded

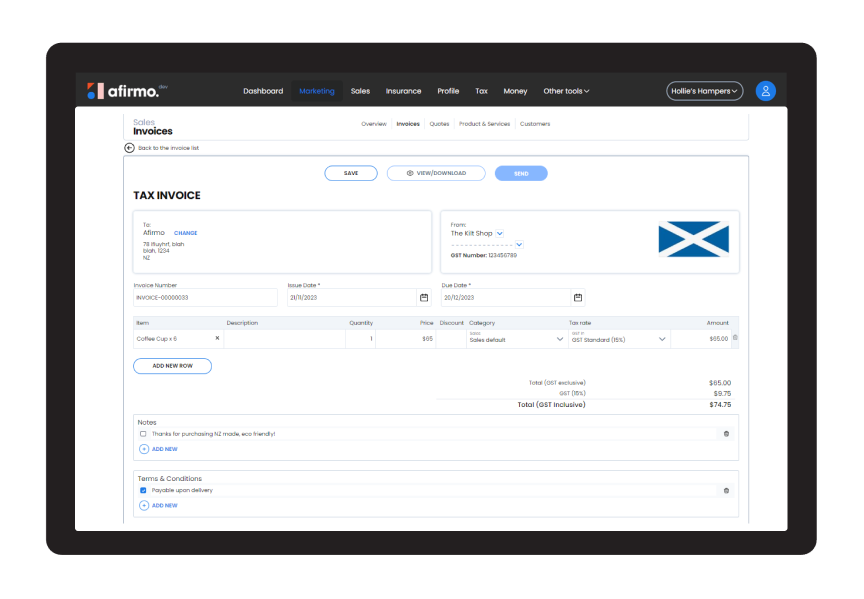

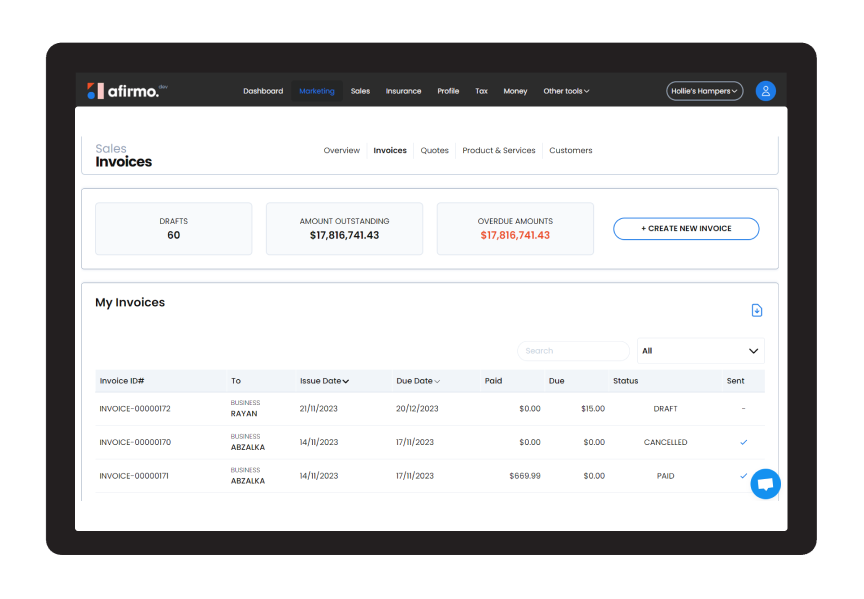

![]() Use the Afirmo sales invoice and quote tool across all plans. No limits and no capsSales Invoices & QuotesUnlimited

Use the Afirmo sales invoice and quote tool across all plans. No limits and no capsSales Invoices & QuotesUnlimited

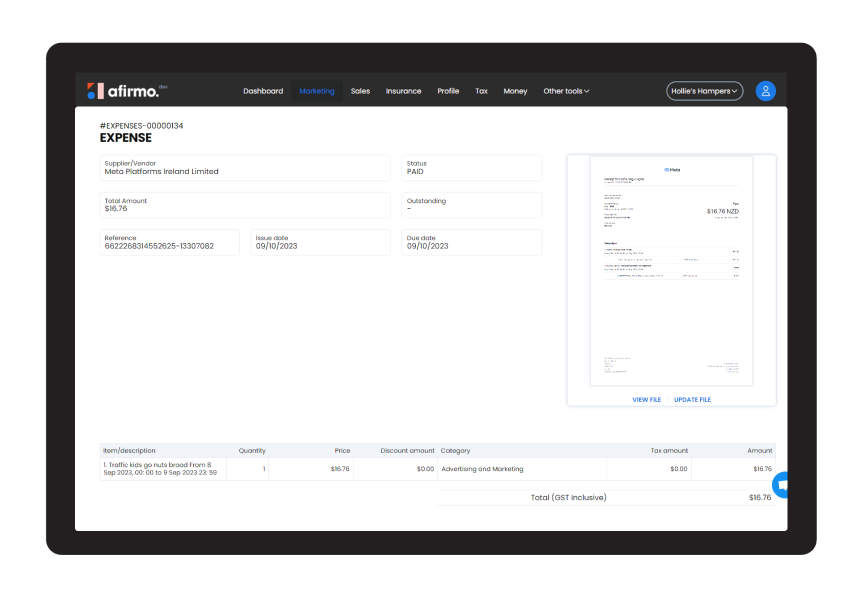

![]() Use the Afirmo expense claim tool across all plans. No limits and no capsExpense ClaimsUnlimited

Use the Afirmo expense claim tool across all plans. No limits and no capsExpense ClaimsUnlimited

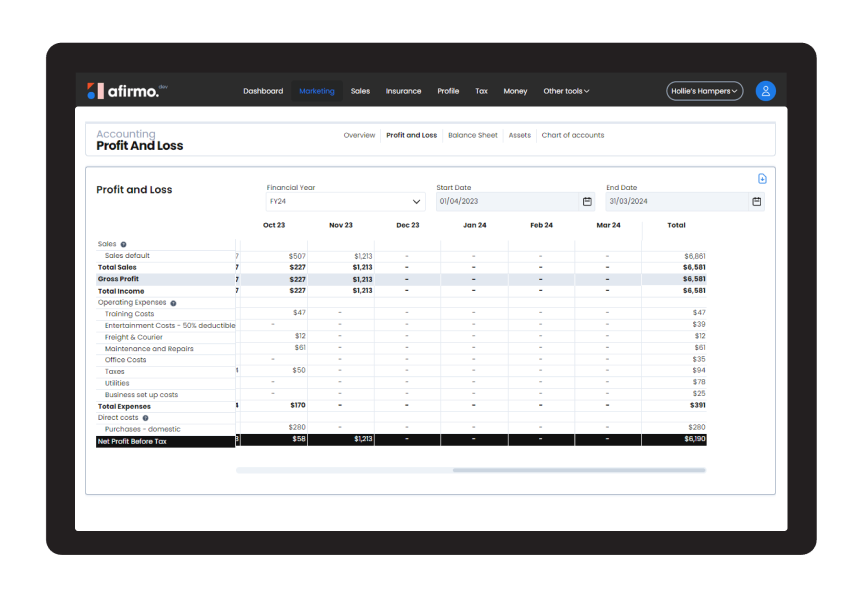

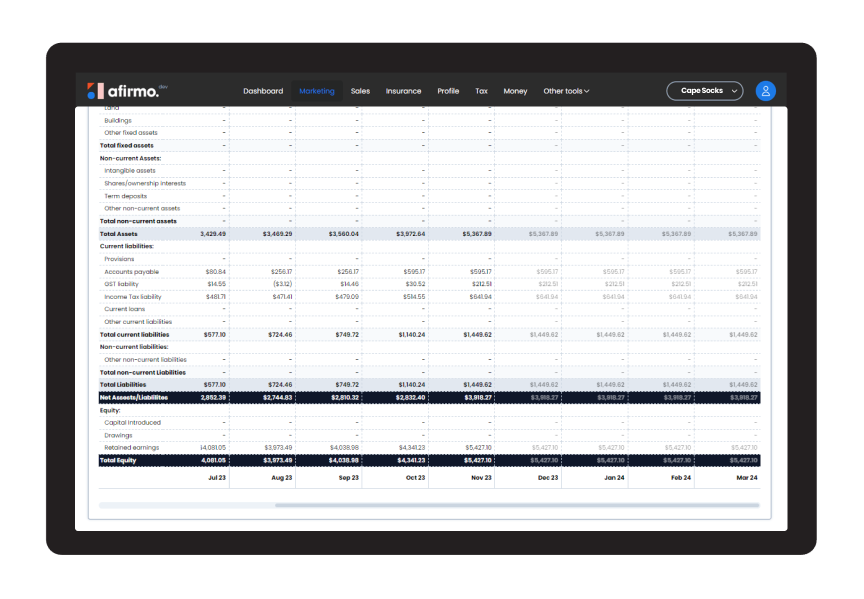

![]() Use the app to generate instant profit & loss accounts and balance sheets for your business. No accounting knowledge requiredProfit & Loss and Balance SheetIncluded

Use the app to generate instant profit & loss accounts and balance sheets for your business. No accounting knowledge requiredProfit & Loss and Balance SheetIncluded

![]() Link your existing bank accounts to Afirmo and match to sales invoices or expense claims and generate business insightsLink Bank Accounts to AfirmoIncluded

Link your existing bank accounts to Afirmo and match to sales invoices or expense claims and generate business insightsLink Bank Accounts to AfirmoIncluded

![]() Get an Afirmo business wallet in minutes to run your business fromBusiness WalletIncluded

Get an Afirmo business wallet in minutes to run your business fromBusiness WalletIncluded

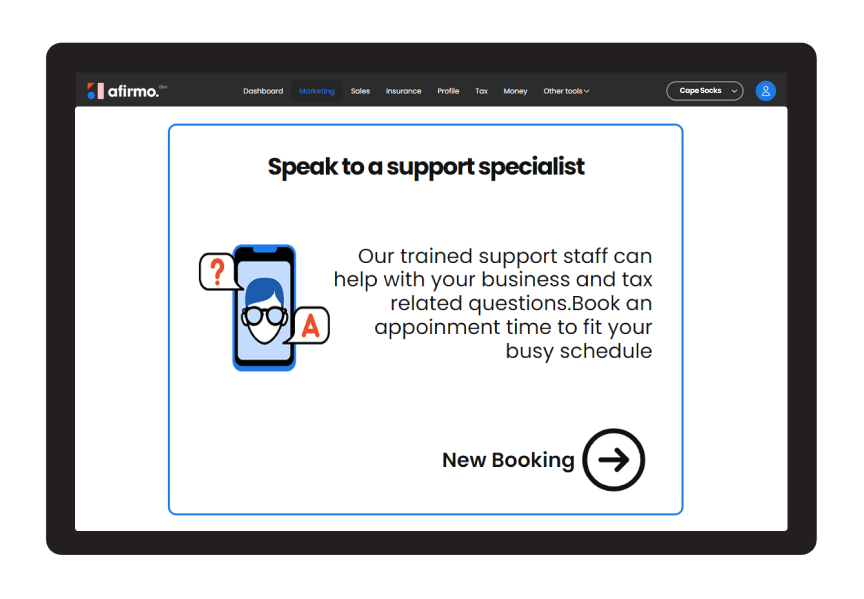

Expert Support

Unlimited

Plan Price

$25 + GST pm

Plan Price

$250 pa

Plan Price

$40 + GST pm

Plan Price

$400 pa

![]() Afirmo will review your business GST returns for you before we file it with the IRD on your behalf as your registered tax agentBusiness GST ReturnsExcluded

Afirmo will review your business GST returns for you before we file it with the IRD on your behalf as your registered tax agentBusiness GST ReturnsExcluded

![]() Afirmo will review your business Income Tax return for you before we file it with the IRD on your behalf as your registered tax agentIncome Tax ReturnIncluded

Afirmo will review your business Income Tax return for you before we file it with the IRD on your behalf as your registered tax agentIncome Tax ReturnIncluded

![]() You can save money in the Afirmo app towards your tax bills. You can authorise us to make the payments to the IRD when they are dueTaxes Paid AutomaticallyIncluded

You can save money in the Afirmo app towards your tax bills. You can authorise us to make the payments to the IRD when they are dueTaxes Paid AutomaticallyIncluded

![]() Afirmo will represent you with the IRD for routine tax queries relating to submitted tax returnsIRD RepresentationExcluded

Afirmo will represent you with the IRD for routine tax queries relating to submitted tax returnsIRD RepresentationExcluded

![]() Companies need to prepare accounts. Afirmo will prepare these for you under the Supercharge planYear End AccountsExcluded

Companies need to prepare accounts. Afirmo will prepare these for you under the Supercharge planYear End AccountsExcluded

![]() Use the Afirmo sales invoice and quote tool across all plans. No limits and no capsSales Invoices & QuotesUnlimited

Use the Afirmo sales invoice and quote tool across all plans. No limits and no capsSales Invoices & QuotesUnlimited

![]() Use the Afirmo expense claim tool across all plans. No limits and no capsExpense ClaimsUnlimited

Use the Afirmo expense claim tool across all plans. No limits and no capsExpense ClaimsUnlimited

![]() Use the app to generate instant profit & loss accounts and balance sheets for your business. No accounting knowledge requiredProfit & Loss and Balance SheetIncluded

Use the app to generate instant profit & loss accounts and balance sheets for your business. No accounting knowledge requiredProfit & Loss and Balance SheetIncluded

![]() Link your existing bank accounts to Afirmo and match to sales invoices or expense claims and generate business insightsLink Bank Accounts to AfirmoIncluded

Link your existing bank accounts to Afirmo and match to sales invoices or expense claims and generate business insightsLink Bank Accounts to AfirmoIncluded

![]() Get an Afirmo business wallet in minutes to run your business fromBusiness WalletIncluded

Get an Afirmo business wallet in minutes to run your business fromBusiness WalletIncluded

Expert Support

Unlimited

Plan Price

$40 + GST pm

Plan Price

$400 pa

Plan Price

$60 + GST pm

Plan Price

$600 pa

![]() Afirmo will review your business GST returns for you before we file it with the IRD on your behalf as your registered tax agentBusiness GST ReturnsUp to 2

Afirmo will review your business GST returns for you before we file it with the IRD on your behalf as your registered tax agentBusiness GST ReturnsUp to 2

![]() Afirmo will review your business Income Tax return for you before we file it with the IRD on your behalf as your registered tax agentIncome Tax Return1 Included

Afirmo will review your business Income Tax return for you before we file it with the IRD on your behalf as your registered tax agentIncome Tax Return1 Included

![]() You can save money in the Afirmo app towards your tax bills. You can authorise us to make the payments to the IRD when they are dueTaxes Paid AutomaticallyIncluded

You can save money in the Afirmo app towards your tax bills. You can authorise us to make the payments to the IRD when they are dueTaxes Paid AutomaticallyIncluded

![]() Afirmo will represent you with the IRD for routine tax queries relating to submitted tax returnsIRD RepresentationIncluded

Afirmo will represent you with the IRD for routine tax queries relating to submitted tax returnsIRD RepresentationIncluded

![]() Companies need to prepare accounts. Afirmo will prepare these for you under the Supercharge planYear End AccountsExcluded

Companies need to prepare accounts. Afirmo will prepare these for you under the Supercharge planYear End AccountsExcluded

![]() Use the Afirmo sales invoice and quote tool across all plans. No limits and no capsSales Invoices & QuotesUnlimited

Use the Afirmo sales invoice and quote tool across all plans. No limits and no capsSales Invoices & QuotesUnlimited

![]() Use the Afirmo expense claim tool across all plans. No limits and no capsExpense ClaimsUnlimited

Use the Afirmo expense claim tool across all plans. No limits and no capsExpense ClaimsUnlimited

![]() Use the app to generate instant profit & loss accounts and balance sheets for your business. No accounting knowledge requiredProfit & Loss and Balance SheetIncluded

Use the app to generate instant profit & loss accounts and balance sheets for your business. No accounting knowledge requiredProfit & Loss and Balance SheetIncluded

![]() Link your existing bank accounts to Afirmo and match to sales invoices or expense claims and generate business insightsLink Bank Accounts to AfirmoIncluded

Link your existing bank accounts to Afirmo and match to sales invoices or expense claims and generate business insightsLink Bank Accounts to AfirmoIncluded

![]() Get an Afirmo business wallet in minutes to run your business fromBusiness WalletIncluded

Get an Afirmo business wallet in minutes to run your business fromBusiness WalletIncluded

Expert Support

Unlimited

Plan Price

$60 + GST pm

Plan Price

$600 pa

Plan Price

$90 + GST pm

Plan Price

$900 pa

![]() Afirmo will review your business GST returns for you before we file it with the IRD on your behalf as your registered tax agentBusiness GST ReturnsUp to 6

Afirmo will review your business GST returns for you before we file it with the IRD on your behalf as your registered tax agentBusiness GST ReturnsUp to 6

![]() Afirmo will review your business Income Tax return for you before we file it with the IRD on your behalf as your registered tax agentIncome Tax Return1 Included

Afirmo will review your business Income Tax return for you before we file it with the IRD on your behalf as your registered tax agentIncome Tax Return1 Included

![]() You can save money in the Afirmo app towards your tax bills. You can authorise us to make the payments to the IRD when they are dueTaxes Paid AutomaticallyIncluded

You can save money in the Afirmo app towards your tax bills. You can authorise us to make the payments to the IRD when they are dueTaxes Paid AutomaticallyIncluded

![]() Afirmo will represent you with the IRD for routine tax queries relating to submitted tax returnsIRD RepresentationIncluded

Afirmo will represent you with the IRD for routine tax queries relating to submitted tax returnsIRD RepresentationIncluded

![]() Companies need to prepare accounts. Afirmo will prepare these for you under the Supercharge planYear End AccountsIncluded

Companies need to prepare accounts. Afirmo will prepare these for you under the Supercharge planYear End AccountsIncluded

![]() Use the Afirmo sales invoice and quote tool across all plans. No limits and no capsSales Invoices & QuotesUnlimited

Use the Afirmo sales invoice and quote tool across all plans. No limits and no capsSales Invoices & QuotesUnlimited

![]() Use the Afirmo expense claim tool across all plans. No limits and no capsExpense ClaimsUnlimited

Use the Afirmo expense claim tool across all plans. No limits and no capsExpense ClaimsUnlimited

![]() Use the app to generate instant profit & loss accounts and balance sheets for your business. No accounting knowledge requiredProfit & Loss and Balance SheetIncluded

Use the app to generate instant profit & loss accounts and balance sheets for your business. No accounting knowledge requiredProfit & Loss and Balance SheetIncluded

![]() Link your existing bank accounts to Afirmo and match to sales invoices or expense claims and generate business insightsLink Bank Accounts to AfirmoIncluded

Link your existing bank accounts to Afirmo and match to sales invoices or expense claims and generate business insightsLink Bank Accounts to AfirmoIncluded

![]() Get an Afirmo business wallet in minutes to run your business fromBusiness WalletIncluded

Get an Afirmo business wallet in minutes to run your business fromBusiness WalletIncluded

Expert Support

Unlimited

Plan Price

$90 + GST pm

Plan Price

$900 pa

A word from Afirmo Customers

⭐⭐⭐⭐⭐

See how Afirmo compares:

As Seen On