Starting and operating a small business can be daunting. However, having a proper accounting system can alleviate many of the financial challenges that come with being an entrepreneur. Accounting systems can help keep track of expenses, manage cash flow, and ensure compliance with relevant statutory requirements.

Five considerations when setting up your Accounting System:

Here are five key tips on how to set up an accounting system that will work for your small business.

Choose the Right Accounting Software for Your Business

The first step in setting up an accounting system for your business is selecting the right accounting software. There are several accounting software options available, and each offers different features and pricing structures. To choose the right accounting software for your business, consider the following:

- Your own accounting knowledge and competence

- Your budget

- The accounting requirements of your business

- The scalability of the software

- The level of support you receive from the software supplier

Afirmo was founded in New Zealand. We understand New Zealand small business accounting requirements. The software is designed to comply with local tax laws and financial regulations, ensuring your business stays compliant without any extra effort on your part. Afirmo streamlines your financial processes, saving you time and allowing you to focus on your business growth

Set up your Chart of Accounts (where all transactions end up)

The Chart of Accounts is a list of all accounts used to record business transactions in the general ledger. It is essential to create a Chart of Accounts that is tailored to your business to provide complete and accurate financial reports. The Chart of Accounts should include all the different types of accounts your business uses daily.

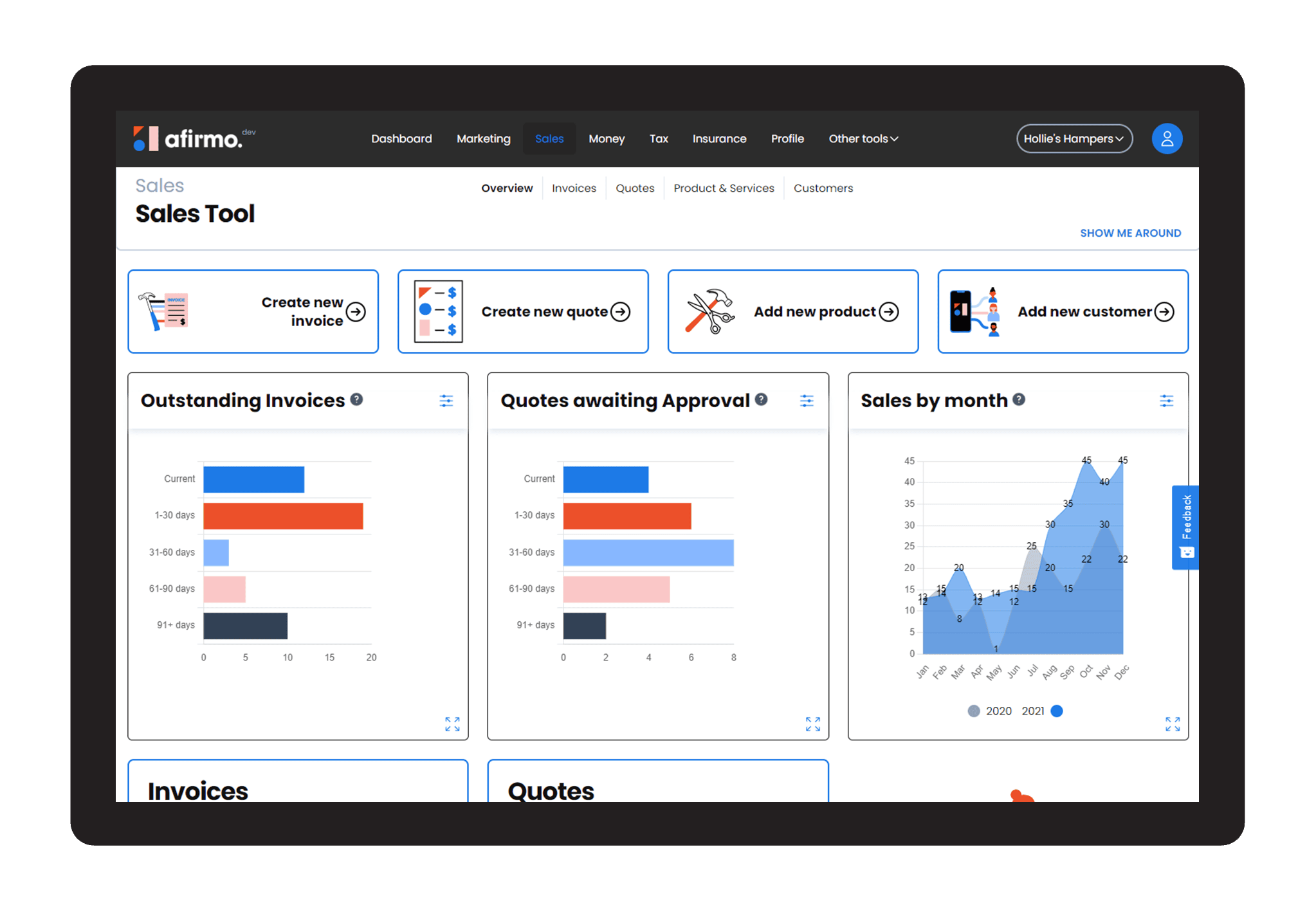

Establish a System for Invoicing and Payments

Invoicing and payment processing help maintain efficient cash flow operations. An efficient accounting system needs an Invoicing and Payment process that allows businesses to manage their accounts receivable and payables.

There are several invoicing and payment processing software solutions available, which can help you keep track of payments and keep on top of your invoices.

Reconcile Accounts Regularly

Bank and credit card accounts are essential to every business, and reconciling these accounts regularly can help reduce errors, detect fraud, and maintain accurate financial records. Regular reconciliations help ensure that the balances in your accounts match the actual transactions occurring in your business.

Keep up with Regulatory Requirements

As a small business owner, you will be required to comply with New Zealand’s regulatory requirements such as GST and income tax. Staying up to date on these requirements is critical as non-compliance can lead to fines, penalties, and even legal action.

Conclusion:

In conclusion, setting up an accounting system for your small business is an essential step to take.

Done correctly, it ensures that finances are well managed, and regulatory requirements are met. Understanding the needs of your business is the key to selecting the right accounting software to use for your operations.

Implementing efficient invoicing and payment processing methods help keep track of accounts receivables and payables.

Regular reconciliation of accounts and staying current with regulatory requirements ensure that your business is on track and healthy.